Reading Time 14 minutes

About: The findings from the Global Innovation Index for 2023 have been released. The GII was first published in 2007 but is now produced by the World Intellectual Property Organization (WIPO). I’ve read it so you don’t have to and have summarised it here. It makes for intriguing findings and several implications for innovation managers and how we run things.

Value: For the non-innovation policy expert, the curious and enthusiastic who want to know a little bit more about how innovation works.

Highlights of the Global Innovation Index 2023

What surprised me was that the UK got anywhere near the top 10. For DECADES it has underinvested in research both corporate and government, and has a weak disconnected industrial strategy. Many big companies are hollowed out in terms of research and commercial bases. Many sectors cry out for plans. Despite this, it is quite efficient in turning inputs to outputs to hit a No 4 position. Among the Top 5 are Switzerland, Sweden, the US and Singapore.

For technologies, two promising innovation waves are making their presence felt across economies and societies: a digital innovation wave, built on artificial intelligence (AI), supercomputing and automation, and a deep science innovation wave, based on biotechnologies and nanotechnologies.

Green supercomputing is becoming more efficient. Renewable energy is increasingly affordable. And the cost of genome sequencing continues to decline.

Spurred on by the scale of the possibilities before us, global top corporate R&D expenditure exceeded USD 1 trillion for the first time last year, with ICT firms as the primary drivers. On the other hand, anaemic growth and high inflation, coupled with the lingering effects of the pandemic, are hampering global innovation in the VC space. A key challenge is converting the potential of novel innovation waves into tangible benefits that flow to everyone, everywhere.

Investments generally are at historic highs. Global R&D grew strongly at a rate of 5.2 per cent in 2021 – close to pre-pandemic growth in 2019. Business R&D grew strongly by 7 per cent – a rate unseen since 2014. The twist is that for VCs it’s down 38% with high inflation and interest rates giving a warning signal. Perhaps the innovation funding Winter is coming…

There is a debate brewing in the UK, about the next industrial strategy. High-value manufacturing is a strength and is vital for trade, productivity, and innovation and yet the debate goes that “services” is the real strategy and that’s where investment should go. This has recently been echoed by the Resolution Foundation.

The Global Innovation Tracker Dashboard: What’s Up what’s Down?

Key:

Green = Positive

Blue = falling behind

Highlights for Innovation Managers

- Think of your system and ecosystem. Think about the relevant innovation input, process and output measures and measure them.

- Measure your strengths and weaknesses. Invest enough to make sure your weaknesses – the innovation hygiene factors – don’t hold you back. Invest and exploit true strengths.

- Spread out the love: stop overinvesting in your existing equivalent of the Golden Triangle and invest in city clusters.

- Recognise the cluster that is important to you. You might have the horsepower to grow a cluster, but at least you can visit and use them.

- How to turn Innovation strengths into Productivity and fix the broken link between Innovation and productivity? Consider the implications of the two innovation waves “Digital Wave” (artificial intelligence, quantum computing, genome sequencing, several green technologies and robotics show a new, possibly groundbreaking dynamic) and “Deep Science Wave” (biotechnologies and nanotechnologies.)

How is the Global Innovation Index built?

The Global Innovation Index is a nation-by-nation survey, so it’s an indicator of how good a nation is at innovation. Eighty-three indicators are used to assess performance over time using an Input-Output formula. Few countries can monitor the ecosystem and deal with weaknesses. But the very idea of focusing on metrics is a good thing for driving interest and for building cross ministry taskforces.

You can manage what you can measure. Let’s take the Idea of Input and Outputs.

Inputs Measures

- Institutions (Institutional, Regulatory and Business Environment)

- Human capital and research (Education, Tertiary Education, R&D)

- Infrastructure (Information and communication technologies, General infrastructure, Ecological sustainability)

- Market sophistication (Credit, Investment, Trade, diversification and market scale)

- Business sophistication (Knowledge workers, Innovation linkages, Knowledge absorption)

Output Measures

- Knowledge and technology outputs (Knowledge creation, Knowledge impact, Knowledge diffusion)

- Creative outputs (Intangible assets, Creative goods and services, Online creativity)

What are the top 10 countries for innovation in 2023?

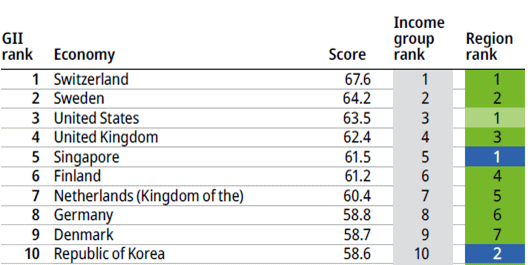

The five economies that spent the most on R&D all experienced significant R&D growth in 2021. In order of R&D budget, they were the United States (+5.6 percent), followed by China (+9.8 percent), Japan (+3.6 percent), Germany (+2.7 percent) and the Republic of Korea (+7.1 percent)

GII 2023 Top 10 Innovative Countries

Innovation Spending by Sector in 2023

Investments generally are at historic highs. Global R&D grew strongly at a rate of 5.2 percent in 2021 – close to pre-pandemic growth in 2019. Business R&D grew strongly by 7 percent – a rate unseen since 2014.

On the corporate side, 2022–2023 R&D data are available for around 1,700 of the top 2,500 biggest corporate R&D spenders worldwide. In 2022, for the first time, corporate R&D expenditure worldwide exceeded the trillion dollar mark (USD 1.1 trillion in private R&D).

Top corporate R&D Intensity is around 4.5% in 2022.

Ranked by R&D intensity in 2022, the top 4 sectors are

- Pharma (15.9 percent),

- Software and ICT services (14.1 percent),

- ICT hardware (7.4 percent)

- Automobiles (4.5 percent)

The amount invested in VC decreased substantially from USD 610 billion in 2021 down to USD 380 billion in 2022. This decline is reminiscent of the financial crisis of 2009, marking a significant drop in VC value. One factor contributing to this decline is a notable increase in inflation, surpassing levels seen in several decades. Higher inflation negatively impacts the valuation of VC firms by necessitating a higher discount rate for future expected cash flows.

The fall in VC value, combined with a growth in the number of deals concluded, resulted in the average deal value halving from USD 31 million in 2021 to USD 16 million in 2022.

Perhaps the (VC) innovation funding Winter is coming…

Technologies

Technological progress is rampant, without many setbacks; technology adoption is growing, but the socioeconomic impact remains weak.

Two promising innovation waves are making their presence felt across economies and societies: a digital innovation wave, built on artificial intelligence (AI), supercomputing and automation, and a deep science innovation wave, based on biotechnologies and nanotechnologies.

Green supercomputing is becoming more efficient. Renewable energy is increasingly affordable. And the cost of genome sequencing continues to decline.

National Scenes

What is the global state of innovation? Is innovation slowing down or accelerating? Switzerland, Sweden, the United States, the United Kingdom and Singapore lead; China, Türkiye, India, Vietnam, the Philippines, Indonesia and the Islamic Republic of Iran are the middle-income economies making the most headway in innovation over the last decade.

I’ve picked these “top 10” for two reasons. Several are obviously of merit and to select countries where my Innovation Conversations subscribers come from.

First, here is the whole listing.

Switzerland

Global Position 1, (Score 67.6)

Strengths (selection)

- Government effectiveness

- Business environment

- Market capitalization

- Innovation linkages

- Knowledge creation, diffusion

- Creative outputs

Weaknesses (selection)

- Government funding/pupil, secondary

- Tertiary enrolment

- Government’s online service

- FDI net inflows

- Labour productivity growth

Sweden

Global Position 2, (Score 64.2)

Strengths (selection)

- Human capital and research

- General infrastructure

- Environmental performance

- Business sophistication

- Knowledge creation

Weaknesses (selection)

- Business environment

- Pupil-teacher ratio, secondary

- ISO 9001 Quality

- Labour productivity growth

USA

Global Position 3, (Score 63.5)

Strengths (selection)

- Research and development

- Credit, Investment, Trade, market scale

- Knowledge workers

- Innovation linkages

- Knowledge Impact

Weaknesses (selection)

- Pupil-teacher ratio, secondary

- Ecological sustainability

- FDI net inflows

- Trademark and Industrial designs by origin

- ISO 9001 Quality

UNITED KINGDOM

Global Position 4, (Score 62.4)

Strengths (selection)

- Information and communication technologies

- Ecological sustainability

- Market sophistication

- Knowledge Impact

- Intangible assets

Weaknesses (selection)

- Operational stability for businesses, FDI net inflows*

- Entrepreneurship policies and culture

- Government funding/pupil, secondary

- Graduates in science and engineering

- Labour productivity growth

* Brexit impact is a major productivity hindrance. Major internal system investment needed

There is a debate brewing in the UK, about the next industrial strategy. High-value manufacturing is a strength and is vital for trade, productivity, and innovation and yet the debate goes that “services” is the real strategy and that’s where investment should go. This has recently been echoed by the Resolution Foundation.

It’s more complicated. And I would advocate the need for selective investment in high-value, technology manufacturing in this era. In a project I did for the UK National Materials Innovation Strategy, the preliminary evidence showed it pointed towards a big weakness in technology translation or commercialisation.

After all, the Inputs of today are the outputs of tomorrow – it’s not good to be complacent.

Singapore

Global Position 5, (Score 61.5)

Strengths (selection)

- Institutional, Regulatory and Business Environment

- PISA scales in reading, maths and science

- Tertiary education

- Information and communication technologies

- Investment

- Business sophistication

Weaknesses (selection)

- Expenditure on education!

- Domestic industry diversification

- Software spending

- Intangible assets

Netherlands

Global Position 7, (Score 60.4)

Strengths (selection)

- Government Effectiveness

- Business Environment

- Entrepreneurship policies and culture

- Finance for start-ups and scale-ups

- Knowledge-intensive employment

- Online creativity

Weaknesses (selection)

- Government funding/pupil, secondary

- Graduates in science and engineering

- Gross capital formation

- Labour productivity growth

Germany

Global Position 8, (Score 58.8)

Strengths (selection)

- Tertiary education

- Global corporate R&D investors

- Logistics performance

- Trade, diversification and market scale

- Knowledge and technology outputs

Weaknesses (selection)

- Government’s online service

- ISO 14001 environment

- Market capitalization

- Females employed w/advanced degrees

- Labour productivity growth

France

Global Position 11, (Score 56.0)

Strengths (selection)

- Global corporate R&D investors

- Trade, diversification and market scale

- Knowledge workers

- Software spending

- Intangible assets

Weaknesses (selection)

- Institutional and business environment

- Gross capital formation

- ISO 14001 environment

- University-industry R&D collaboration

Ireland

Global Position 22, (Score 50.4)

Strengths (selection)

- Ecological sustainability

- Knowledge workers

- Intellectual property payments

- Knowledge diffusion

Weaknesses (selection)

- Education

- Knowledge creation

- Gross expenditure on R&D

- Market sophistication

Mexico

Global Position 58, (Score 31.0)

Strengths (selection)

- Research and development

- Trade, diversification and market scale

- High-tech imports

- High-tech manufacturing

- Creative goods and services

Weaknesses (selection)

- Institutional, Regulatory and Business Environment

- Labour productivity growth

- Venture capital (VC) investors

- Government funding/pupil, secondary

Technology Trajectories

What if the technology angle; of its creation, adoption and how it spreads?

Now, consider the four key stages in the innovation cycle: (1) science and innovation investment; (2) technological progress; (3) technology adoption; and (4) the socioeconomic impact of innovation.

(1) science and innovation investment

Science and innovation investment showed a mixed performance in 2022. Global government R&D budgets are expected to grow in real terms in 2022, while R&D expenditure by top corporate spenders rose substantially, but are now slowing.

(2) technological progress

Strong technological progress in the fields of information technology, health, mobility and energy continues to deliver breakthroughs opening up new opportunities for global development.

(3) technology adoption

Electric vehicle (EV) uptake is booming, and the desire for greater automation has increased robot installation. Overall penetration rates remain medium-to-low. Making access to safe sanitation and connectivity more widespread.

(4) The socioeconomic impact of innovation remains low.

The COVID-19 crisis triggered volatility in labour productivity – which is currently at a standstill – and life expectancy fell for a second consecutive year.

Recent economic and political headwinds have impeded international patent filings, with growth throughout 2021 of 0.8 per cent was yet more sluggish in 2022 (0.3 per cent), representing the slowest rate of increase since the decline in PCT applications seen in 2009.

Clusters are Key to a Nation’s Prospects

The world’s five biggest science and technology clusters are all located in East Asia; Tokyo–Yokohama is the biggest S&T cluster globally, and Cambridge, UK the most S&T-intensive.

Then in the Emerging economies, there are four clusters in India. LatAm has just one cluster but there are none in Sub-Saharan Africa.

They’re important because of the Spillovers and Returns to Innovation that sustain the cluster, innovation and economic outputs.

Implications for Innovation Leaders

- Be honest about your strengths and weaknesses. See Innovation Assessment – know your SWOT and act on them.

- Innovation is a Systemic issue; that brings together different factors. Think of your system and ecosystem not single points. Invest in tangibles and non-tangibles

- Spread out the love: stop overinvesting in the Golden Triangle.

- How to turn Innovation strengths into Productivity? Fix the broken link between Innovation and productivity. TWO innovation waves “Digital Wave” (artificial intelligence, quantum computing, genome sequencing, several green technologies and robotics show a new, possibly groundbreaking dynamic) and the “Deep Science Wave” (biotechnologies and nanotechnologies.)

Like this article?

CLICK HERE to stay ahead and get regular Innovation Success Insights delivered straight to your email box

Want to know more?

Rob Munro delivers strategic innovation services to companies, universities and government agencies giving business and innovation leaders the practices, tools and confidence to achieve best-in-class innovation results. Please contact me to discuss ways to bring greater effectiveness to your innovation processes.

Read more about my service to organisations for innovation planning in improving innovation results.

References

- Global Innovation Index 2023, Innovation in the face of uncertainty, 16th Edition, WIPO 2023

- Podcast, Why does the UK do so well on the Global Innovation Index? 10th November 2023, The Productivity Institute, UK